Tin, a vital industrial metal, is widely used in soldering, plating, and manufacturing processes across industries such as electronics, packaging, and automotive. Its versatility and growing demand in emerging technologies have made tin a critical component in the global supply chain. Understanding theTin Price Trendis crucial for manufacturers, suppliers, and procurement professionals to manage costs and adapt to market changes. This article explores tin's latest price trends, market dynamics, historical data, forecasts, and regional insights.

Latest Price Trends

The tin market has experienced considerable price volatility over the past few years due to shifts in demand, supply chain disruptions, and geopolitical factors. Key factors driving the current price trends include:

- Growing Electronics Demand:

Tin is a key component in soldering, accounting for nearly 50% of its global consumption. The increasing adoption of electronics, including semiconductors, 5G devices, and consumer electronics, has significantly boosted tin demand, putting upward pressure on prices. - Supply Constraints:

Tin mining is concentrated in a few regions, such as Indonesia, China, and Peru. Production cuts due to regulatory changes, declining ore grades, and geopolitical tensions have contributed to tighter supplies, leading to higher prices. - Energy and Logistics Costs:

Rising energy costs and shipping delays have increased production and transportation expenses for tin, further influencing its market price. This is especially impactful for regions reliant on imports. - Stockpile Policies and Speculation:

The strategic stockpiling of tin by governments and speculation in commodity markets have also affected prices. For instance, the recent stockpiling by China has added to price volatility.

Market Analysis

Demand Drivers

- Electronics and Technology:

The electronics sector is the largest consumer of tin, using it as a soldering material in printed circuit boards (PCBs) and other components. With the rise of 5G technology, IoT devices, and electric vehicles (EVs), tin demand is expected to remain strong. - Packaging and Coatings:

Tin is used in food-grade packaging and protective coatings due to its corrosion resistance and non-toxicity. The growing demand for sustainable packaging solutions has bolstered this segment. - Emerging Technologies:

Tin is increasingly being used in renewable energy systems and battery technologies, driven by the global push for sustainability and clean energy adoption.

Enquire For Regular Prices:https://www.procurementresource.com/resource-center/tin-price-trends/pricerequest

Supply-Side Challenges

- Mining Limitations:

Tin mining is geographically concentrated, with Indonesia, China, and Peru being the largest producers. Any disruptions in these regions, such as weather events or regulatory changes, directly impact global supplies. - Declining Ore Grades:

Many of the worlds tin mines are experiencing declining ore grades, requiring more investment and energy to extract tin, leading to higher costs and tighter supply. - Environmental Regulations:

Stricter environmental policies in major producing regions, particularly in Asia, have limited mining activities, contributing to supply constraints.

Historical Data and Forecasts

Historical Price Trends

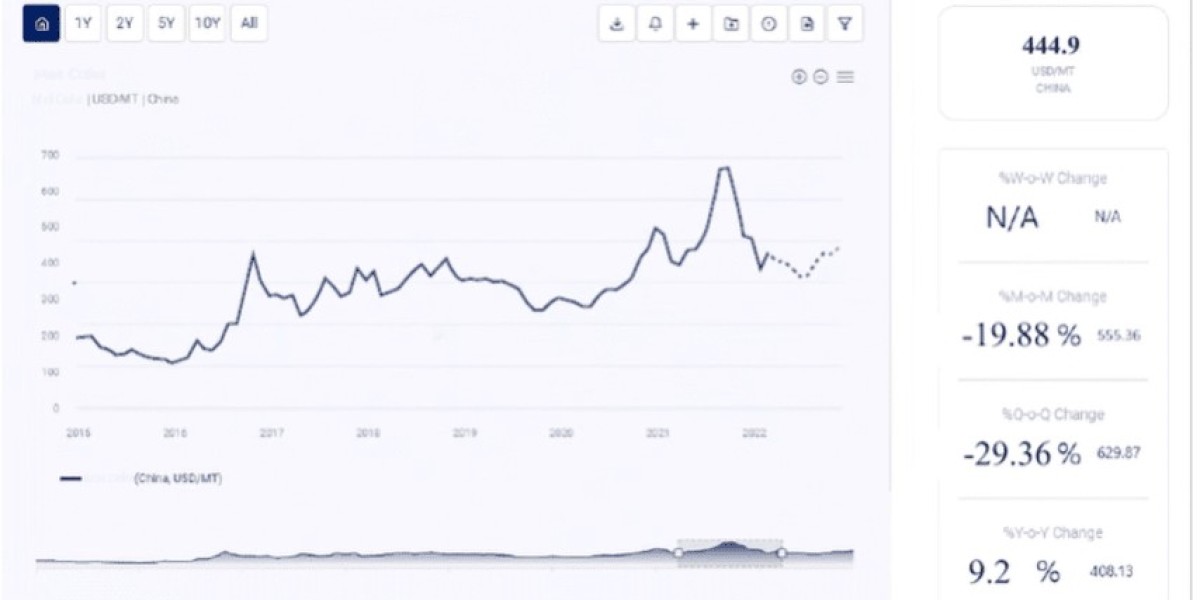

Over the past decade, tin prices have shown cyclical fluctuations influenced by economic conditions, demand growth, and production challenges. Key historical trends include:

- 2010-2015: Prices were relatively stable due to balanced supply-demand dynamics.

- 2016-2018: A moderate price increase was observed, driven by growing demand for consumer electronics.

- 2020-2021: Tin prices surged to historic highs as COVID-19 disrupted supply chains, while demand for electronics skyrocketed due to remote work and digitalisation.

- 2022-Present: Prices remain elevated but have shown some volatility due to geopolitical tensions, supply chain recovery efforts, and fluctuating energy costs.

Forecasts

Industry forecasts indicate that tin prices will remain high in the short term due to persistent supply constraints and rising demand from key sectors such as electronics and renewable energy. However, technological advancements in tin recycling and alternative materials may stabilise prices in the long term. The transition to green energy and electric vehicles is expected to further drive tin demand over the next decade.

Database Insights and Chart Representation

Access to reliable databases and price charts is essential for understanding theTin Price Trendand making informed decisions. These tools provide historical data, price forecasts, and insights into regional market dynamics.

Key Observations

- Regional Price Variations: Tin prices are generally higher in import-dependent regions such as North America and Europe due to shipping costs and tariffs. In contrast, Asia-Pacific enjoys relatively stable prices owing to its proximity to major tin producers like Indonesia and China.

- Seasonal Trends: Seasonal mining activities and fluctuations in electronics production cycles contribute to periodic price changes.

By analysing price charts and leveraging market intelligence tools, businesses can better plan procurement strategies and mitigate risks associated with price volatility.

Market Insights

Technological Innovation in Recycling

Tin recycling is gaining traction as a cost-effective and sustainable solution to meet rising demand. Innovations in recycling technologies are expected to improve recovery rates, reduce waste, and alleviate some supply pressures.

Green Energy Applications

The adoption of renewable energy technologies and electric vehicles is creating new growth opportunities for tin. It is being used in advanced batteries, solar panels, and energy storage systems, which are critical to the clean energy transition.

Sustainability Trends

Sustainability initiatives are reshaping the tin market. Companies are investing in eco-friendly mining practices and exploring alternatives to traditional tin applications to meet environmental goals.

Regional Insights and Analysis

Asia-Pacific

Asia-Pacific is the largest producer and consumer of tin, with Indonesia and China dominating production. The region benefits from abundant resources and strong demand from its electronics manufacturing hubs. However, environmental regulations and trade policies in China have occasionally disrupted supplies.

North America

The North American tin market is heavily influenced by demand from the electronics and automotive sectors. Limited domestic production and reliance on imports expose the region to price volatility.

Europe

Europes tin market is shaped by its focus on sustainable technologies and renewable energy adoption. The regions limited domestic mining capacity and strict environmental regulations contribute to higher prices.

Latin America and Africa

Latin America, particularly Peru and Bolivia, is a significant tin-producing region, while Africa is emerging as a key market due to growing mining activities and infrastructure development.

Role of Procurement Resource

Platforms likeProcurement Resourceprovide critical insights into theTin Price Trendby offering:

- Real-Time Price Tracking: Stay updated on the latest price movements across regions.

- Market Intelligence: Access historical data, demand forecasts, and regional analysis.

- Cost Optimisation: Identify cost-effective sourcing options and minimise procurement risks.

By leveraging Procurement Resource, businesses can make informed decisions, manage price volatility, and optimise their supply chains.

TheTin Price Trendis shaped by a complex interplay of supply-side constraints, growing industrial demand, and sustainability-driven innovation. Understanding these factors is essential for navigating market complexities and securing a competitive edge in the global tin market.

Contact Us:

Company Name: Procurement Resource

Contact Person: Leo Frank

Email:[email protected]

Toll-Free Numbers:

- USA Canada: +1 307 363 1045

- UK: +44 7537171117

- Asia-Pacific (APAC): +91 1203185500

Address: 30 North Gould Street, Sheridan, WY 82801, USA